In "The Intelligent Investor's Approach to Risk Mastery," Balaji Kasal provides a comprehensive guide to mastering risk in the investment world. Building on the principles of Warren Buffett and Peter Bernstein, the book emphasizes that successful investing prioritizes risk management over chasing returns. Kasal's four-part approach tackles risk holistically, covering mindset transformation, understanding business ecosystems, identifying exceptional management, and recognizing profitable investment opportunities. This practical guide equips readers with strategies to minimize losses, weigh opportunity costs, and ultimately, transform uncertainty into profit, paving the path to long-term financial success and building enduring wealth. This is the second book in the "Intelligent Investor" series, designed to help readers achieve financial independence.

Review The Intelligent Investor's Approach to Risk Mastery

This book, "The Intelligent Investor's Approach to Risk Mastery," really resonated with me. I've read a fair share of investment books, but this one stands out for its holistic approach to risk management. It’s not just about crunching numbers and analyzing financial statements; it digs deep into the psychological aspects of investing, which I think is often overlooked. The author, Balaji Kasal, clearly understands that our emotional responses – our fears and biases – are just as much a risk factor as market volatility.

The book's strength lies in its ability to break down complex investment concepts into easily digestible pieces. It avoids overwhelming the reader with jargon, instead focusing on clear, practical strategies. The four-part structure is well-designed, guiding you through a journey of self-awareness, business analysis, management assessment, and finally, identifying those unique opportunities that can truly set you apart from the crowd.

I particularly appreciated the emphasis on transforming your mindset. It's a refreshing take on investing, recognizing that mastering your emotions and understanding your own biases is crucial for long-term success. The book doesn't shy away from the challenges involved, acknowledging that investing inherently involves uncertainty, but it empowers you with the tools and strategies to navigate that uncertainty and even turn it to your advantage. The discussions about recognizing and mitigating the impact of loss aversion – that gut-wrenching feeling when your investments drop – felt particularly insightful and relevant.

The sections on identifying exceptional businesses and assessing management teams were also invaluable. It’s not just about finding companies with high growth potential; it’s about understanding the underlying business model, the competitive landscape, and the integrity and competence of the people running the show. The book provides a solid framework for doing this thorough due diligence, emphasizing the importance of long-term compounding returns over chasing short-term gains. This long-term perspective is crucial, and often missing in other investment literature that focuses heavily on short-term market fluctuations.

While the book focuses on risk management, it doesn't paint a picture of investing as a purely defensive endeavor. Instead, it positions risk management as a crucial foundation for building wealth and achieving your financial goals. By understanding and managing risk effectively, you free yourself to capitalize on the many opportunities the market presents, turning uncertainty into profit and accelerating your success.

Overall, I found "The Intelligent Investor's Approach to Risk Mastery" to be a highly valuable and practical resource. It's a book that I would recommend to both seasoned investors looking to refine their strategies and beginners taking their first steps into the world of finance. The author's passionate commitment to helping readers achieve financial independence is evident throughout, making the book both informative and inspiring. I’m looking forward to exploring the first book in the series as well, based on the strong foundation laid here. It's a worthwhile investment in your own financial future.

Information

- Dimensions: 5 x 0.58 x 8 inches

- Language: English

- Print length: 228

- Publication date: 2024

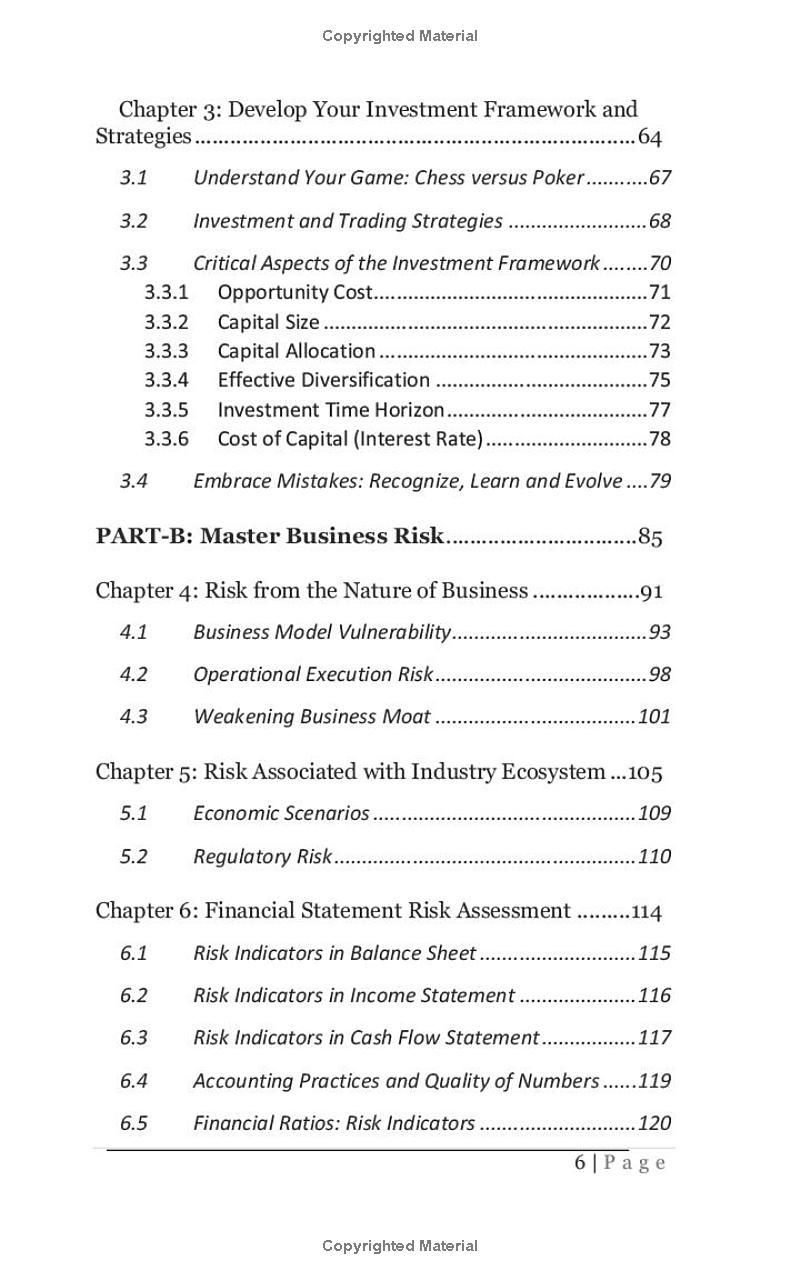

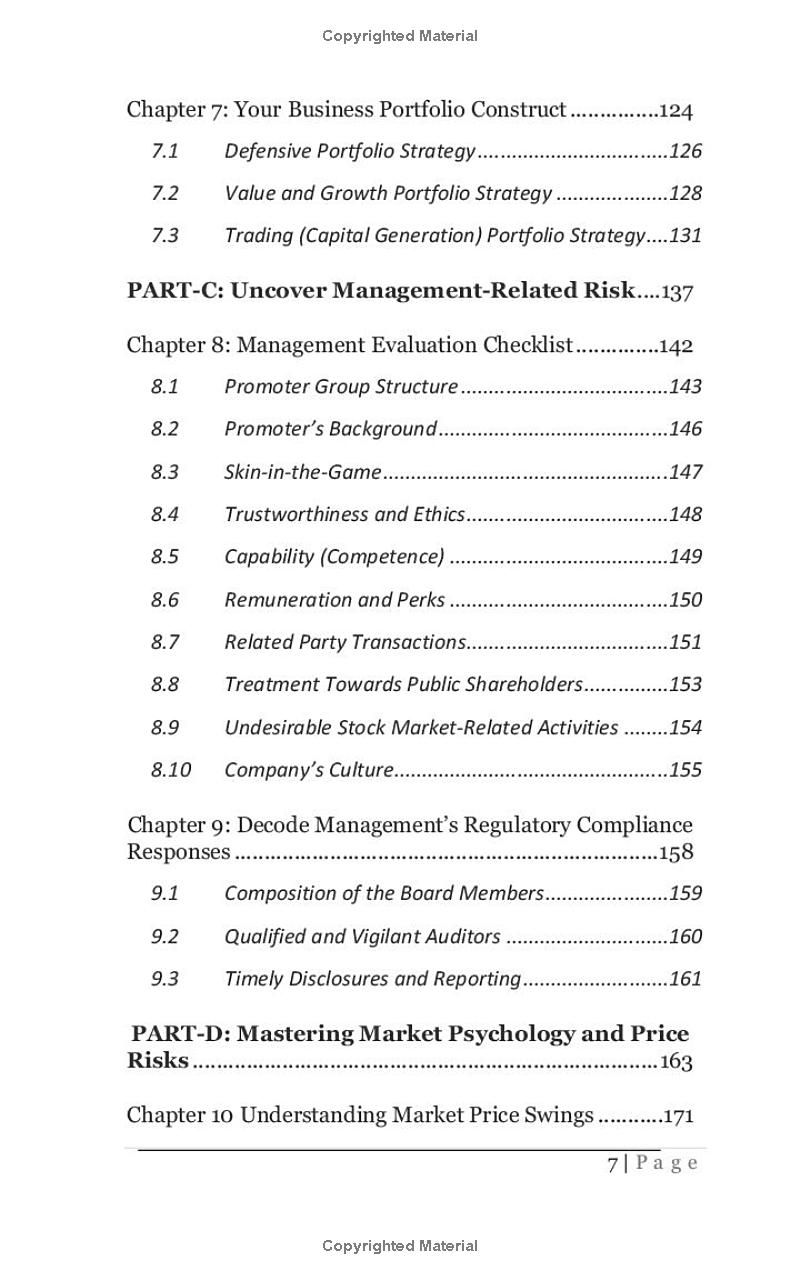

Book table of contents

- Preface

- Introduction

- PART-A: Self-Mastery: Successful Investment Journey

- Chapter 1: Master Your Behavioral Biases

- Chapter 2: Evolve Your Decision-Making Process

- Chapter 3: Develop Your Investment Framework and Strategies

- PART-B: Master Business Risk

- Chapter 4: Risk from the Nature of Business

- Chapter 5: Risk Associated with Industry Ecosystem

- Chapter 6: Financial Statement Risk Assessment

- Chapter 7: Business Portfolio Construct

- PART-C: Uncover Management-Related Risk_

- Chapter 8: Management Evaluation Checklist

- Chapter 9: Decode Management's Regulatory Compliance Responses

- PART-D: Mastering Market Psychology and Price Risks

Preview Book